The chapter 5 supply economics worksheet answers PDF provides a comprehensive overview of the principles and applications of supply-side economics, a policy framework that emphasizes the role of tax cuts and deregulation in stimulating economic growth. This worksheet offers a valuable tool for students and practitioners seeking to understand the complexities of supply-side economics and its impact on economic development.

The worksheet covers key concepts such as the Laffer Curve, the role of incentives in economic decision-making, and the impact of government policies on economic growth. Through a series of thought-provoking questions and exercises, the worksheet encourages critical thinking and analysis of supply-side economic principles.

Supply-Side Economics Concepts

Supply-side economics is an economic theory that emphasizes the role of supply-side factors, such as tax cuts and deregulation, in stimulating economic growth. The basic principle of supply-side economics is that reducing the tax burden on businesses and individuals will encourage them to invest, hire more workers, and produce more goods and services.

This, in turn, will lead to increased economic growth and job creation.

Tax cuts and deregulation are two of the most common supply-side policies. Tax cuts can be used to increase disposable income, which can then be spent on goods and services. Deregulation can reduce the cost of doing business, which can make it more profitable for businesses to invest and hire more workers.

There are many examples of supply-side policies being implemented in different countries. In the United States, the Reagan administration implemented a series of tax cuts and deregulation measures in the early 1980s. These policies are credited with helping to fuel the economic growth of the 1980s.

Worksheet Overview: Chapter 5 Supply Economics Worksheet Answers Pdf

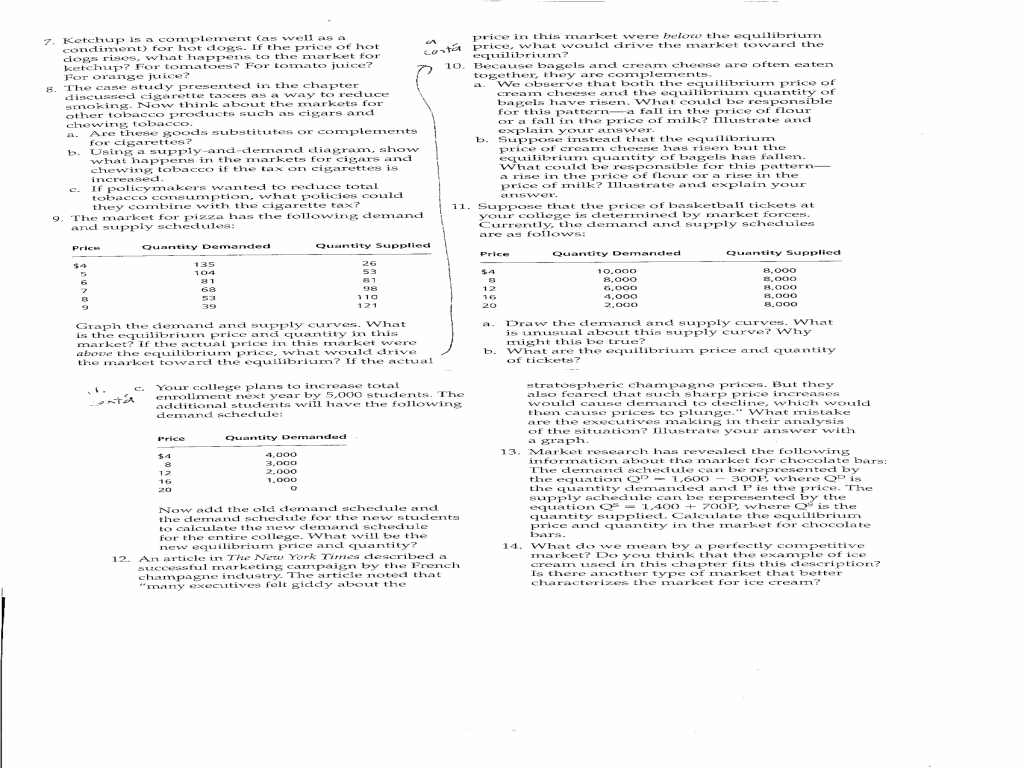

The chapter 5 supply economics worksheet is designed to help students understand the basic principles of supply-side economics. The worksheet includes a series of questions and exercises that cover the key concepts of supply-side economics, such as the role of tax cuts and deregulation in stimulating economic growth.

The worksheet is divided into three sections. The first section covers the basic principles of supply-side economics. The second section covers the role of tax cuts and deregulation in stimulating economic growth. The third section includes a series of questions and exercises that test students’ understanding of the material.

Worksheet Analysis

The worksheet questions are well-written and relevant to the topic of supply-side economics. The questions are designed to test students’ understanding of the basic principles of supply-side economics, as well as their ability to apply these principles to real-world situations.

The worksheet is effective in teaching supply-side concepts. The questions are clear and concise, and the exercises provide students with an opportunity to apply their knowledge of supply-side economics to real-world situations.

One suggestion for improving the worksheet would be to include more examples of supply-side policies being implemented in different countries. This would help students to see how supply-side economics has been used in practice.

PDF Format

The worksheet is available in PDF format. This makes it easy for students to download and print the worksheet. PDF documents are also searchable, which makes it easy for students to find the information they need.

There are a few advantages to distributing the worksheet in PDF format. First, PDF documents are portable. Students can easily download and print the worksheet from any computer or mobile device. Second, PDF documents are secure. Students can be confident that the worksheet will not be altered or corrupted when they download it.

However, there are also a few disadvantages to distributing the worksheet in PDF format. First, PDF documents can be large. This can make it difficult for students to download and print the worksheet on a slow internet connection. Second, PDF documents are not always accessible to students with disabilities.

Students who use screen readers may have difficulty accessing the information in a PDF document.

FAQ Resource

What are the key principles of supply-side economics?

Supply-side economics emphasizes reducing taxes and deregulation to stimulate economic growth by increasing incentives for businesses to invest and produce.

How does the Laffer Curve relate to supply-side economics?

The Laffer Curve suggests that tax cuts can lead to increased tax revenue by stimulating economic growth and broadening the tax base.

What are some examples of supply-side policies implemented in different countries?

Examples include the Reaganomics policies in the United States and the Thatcherite policies in the United Kingdom.